Sharing money has become the norm, as millennials navigate new types of relationships—both personal, and financial. New products from the financial services industry are targeting unmarried partners and roommates, catering to more casual levels of investment than a joint bank account.

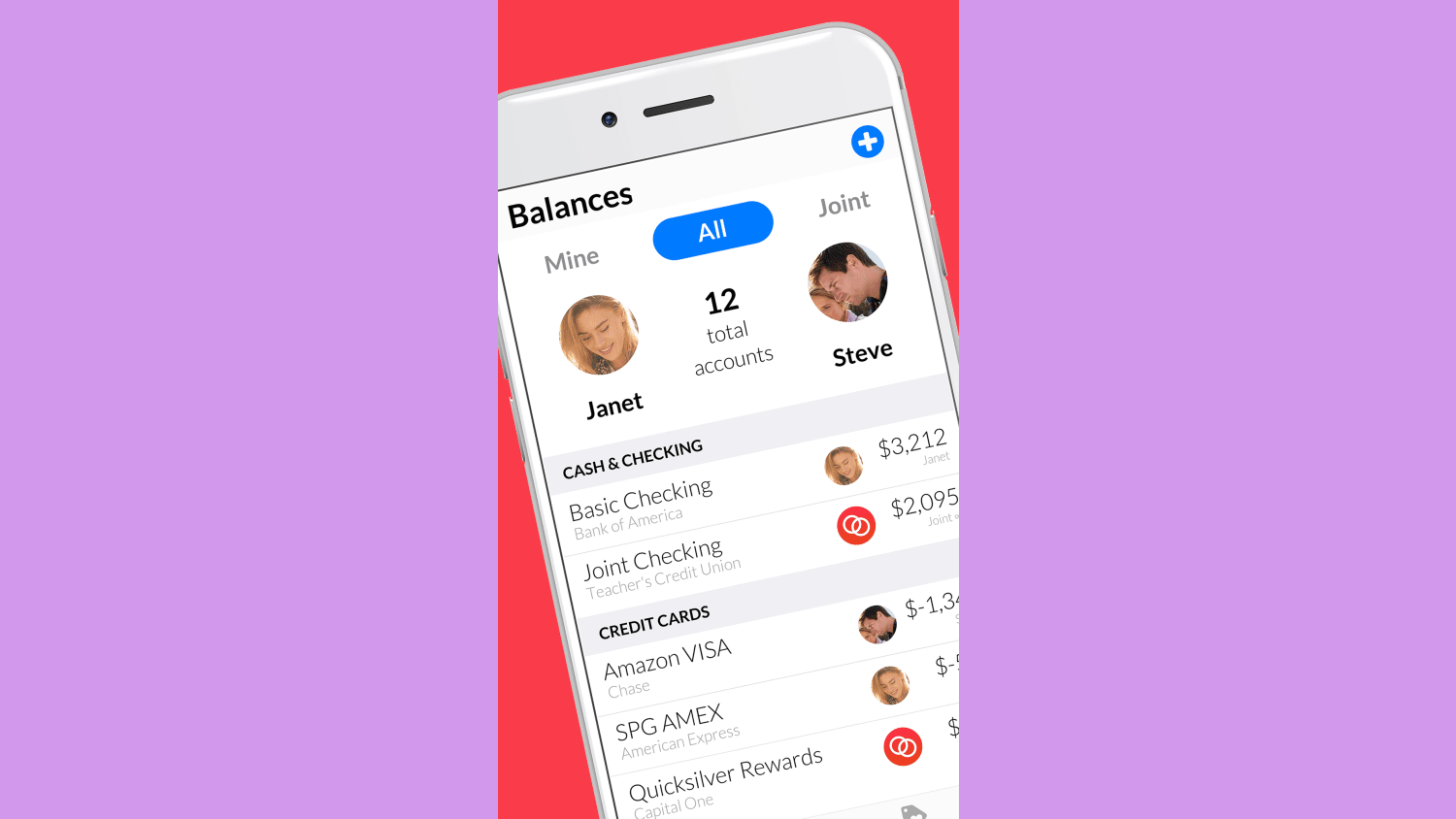

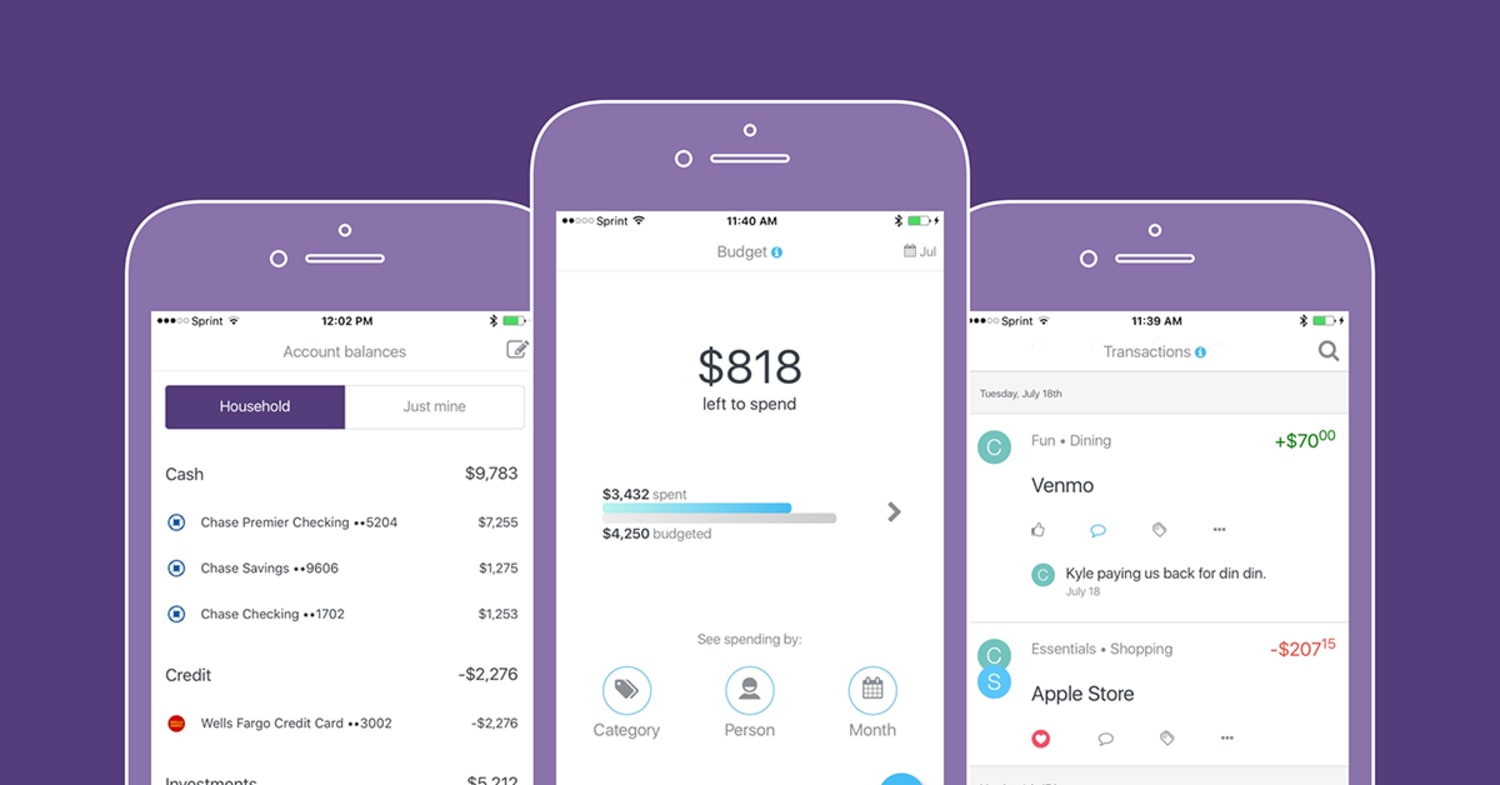

Several companies have realized the market for the 18 million US millennials who live with a partner before marriage, half of whom merge finances before marriage. Honeydue, launched at the beginning of August, and Honeyfi, launched this week, both use mobile banking to connect to the “Venmo generation.” For both apps, couples can link their accounts to the app, decide what to share with their partner, and then organize and track their finances in the same place, allowing couples to share their account information easily.